Assessor

Citywide Property Revaluation Underway

The City of Richland Center has partnered with Accurate Assessor to complete a community-wide revaluation of property assessments for 2025. This process ensures fair and equitable taxation by updating assessed values based on recent real estate market activity.

Why Is This Happening

Under Wisconsin law, municipalities must maintain accurate property assessments that reflect current market conditions. Property sales from 2024 are being reviewed to set 2025 assessed values. This process helps ensure that no property is paying more or less than its fair share in local taxes.

What does this Mean for You

Assessments are used to fairly distribute the tax burden. The property tax burden is redistributed after the market update based on all properties being assessed to fair market value.

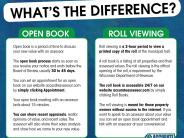

How to Review & Discuss Your Assessment

Open Book has now concluded for Richland Center but property owners may still contact Accurate Assessor at (920) 749-8098 or email info@accurateassessor.com with questions or to clarify their assessment.

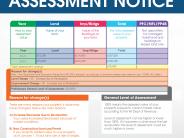

Board of Review – Formal Appeal Process

If you disagree with your assessment after your Open Book discussion, you may file an appeal with the Board of Review:

- Deadline to File an Appeal: Monday, October 13, 2025, at 4:30PM.

- *NOTE* Appeal must be received in the Clerk's Office at 450 S Main Street BY 4:30 PM on Monday, October 13, 2025.

- Board of Review Hearing: Wednesday, October 15, 2025, from 5:30PM - 7:30PM at Richland Center Municipal Building

To file an appeal:

- Submit the Objection to Real Property Assessment (PA-115A) form to the Clerk/Deputy Clerk - clerk@richlandcenterwi.gov

- We encourage you to use the Open Book period for any questions. Signing up early ensures you and The assessor have sufficient time to allow for completion and avoid any last-minute delays.

RESOURCES

Assessment Timeline

Key milestones in the revaluation process include:

- January 1, 2025: Market value cutoff date

- September 8-9, 2025: Open Book (8AM -4PM at the Richland Municipal Building)

- October 13, 2025: Deadline to File an Appeal (4:30PM)

- October 15, 2025: Board of Review hearings

- Mid December 2025: 2025 tax bills mailed